Understanding your customers goes beyond just knowing their names and preferences. It’s about grasping the full potential of their value to your business over time. This is where Customer Lifetime Value (CLV) becomes a game-changer.

CLV is a pivotal metric that shines a light on the true worth of your customers, helping shape smarter, more effective marketing strategies and fostering robust customer relationships. By the end of this article, you’ll not only grasp what CLV means but also know how to calculate it and use this knowledge to drive your business growth.

What is Customer Lifetime Value (CLV)?

Simply put, Customer Lifetime Value (CLV) is the total value a customer brings to a business over their entire relationship. It’s not just about the profit gained from a customer’s purchases. Rather than focusing on individual transactions, CLV takes into account the overall value a customer adds to your business over time.

Think of CLV as a long-term relationship rather than a one-time transaction. It’s like having a good friend who not only supports your business by buying your products but also recommends you to others, enhancing your brand’s reputation and potentially bringing in new customers.

Why is CLV important?

CLV stands out among other metrics for several reasons

- Knowing the CLV helps businesses identify the most profitable customer segments, allowing them to focus their efforts and resources more efficiently.

- It guides marketers in making decisions on the appropriate amount to spend on gaining new customers as well as keeping current ones.

- Understanding the value of a customer over time encourages businesses to nurture longer, more rewarding relationships.

- A high CLV can indicate a sustainable business model, as it points to a loyal customer base and a steady revenue stream.

CLV vs other metrics

While metrics like conversion rates and average order value are important, they only give a snapshot of customer behavior. CLV, on the other hand, offers a comprehensive view, combining various elements like purchase frequency, order value, and customer loyalty. It’s like looking at the entire storyline of a customer’s journey with your brand, rather than just a single chapter.

The components of CLV

To fully appreciate Customer Lifetime Value, we need to break it down into its core components. These are Average Purchase Value (APV), Purchase Frequency (PF), and Customer Lifespan (CL). Let’s unpack each one.

1. Average Purchase Value (APV)

This is the average amount a customer spends in a single transaction. To calculate APV, divide the total revenue over a specific period by the number of purchases in that period.

APV sample calculation If your eCommerce store made $100,000 last year from 1,000 purchases, your APV would be $100,000 / 1,000 = $100

APV is critical because it provides insights into customer spending behavior, helping tailor marketing strategies to boost this value.

2. Purchase Frequency (PF)

This measures how often customers buy from you. Calculate it by dividing the total number of purchases by the number of unique customers in a given period.

PF sample calculation If those 1,000 purchases last year were made by 300 unique customers, then PF is 1,000 / 300 ≈ 3.33

Understanding PF helps in identifying loyal customers and assessing the effectiveness of your customer retention strategies.

3. Customer Lifespan (CL)

This is an estimate of the duration of the relationship between your business and a customer. It can be trickier to calculate as it involves predicting future behavior based on past data.

CL sample calculation If your records show that customers typically continue purchasing from your store for an average of 3 years, then CL is 3 years

Besides these three, other factors also influence CLV.

Customer service

Exceptional service can increase CLV by enhancing customer satisfaction and loyalty.

Brand loyalty

A strong brand connection can lead to higher purchase frequency and a longer customer lifespan.

Marketing strategies

Effective strategies can increase both APV and PF, thereby enhancing CLV.

Calculating Customer Lifetime Value

Now that you understand the components, let’s put them together to calculate CLV.

Formula for CLV

CLV = APV × PF × CL

Let’s use an example to illustrate this

- APV (Average Purchase Value): $100

- PF (Purchase Frequency): 3.33 times/year

- CL (Customer Lifespan): 3 years

So, CLV = $100 × 3.33 × 3 ≈ $999. This means, on average, each customer is worth about $999 to your business over their relationship with you.

Advanced CLV Calculations

For businesses looking for a more nuanced understanding of CLV, advanced models come into play. These often involve predictive analytics and take into account factors like the changing nature of customer behavior, the impact of marketing efforts, and economic trends. These models can be complex, typically requiring specialized software and data analysis skills. However, they offer a dynamic and more accurate estimation of CLV, particularly useful in highly competitive or rapidly changing markets.

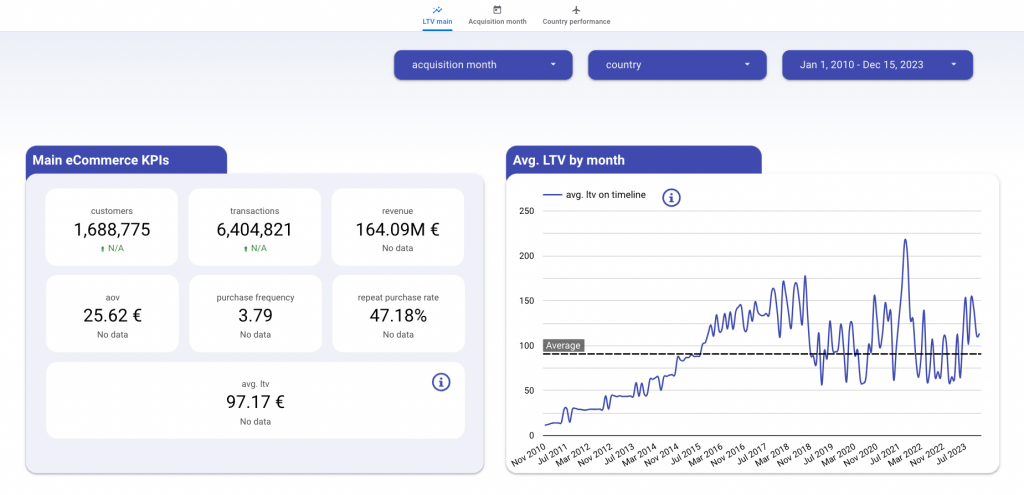

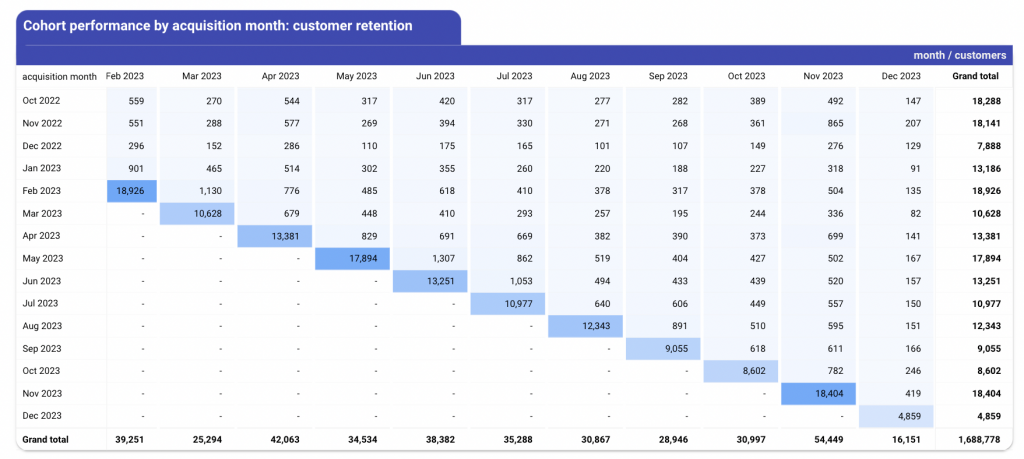

Here are examples of dashboards scandiweb has prepared for CLV analysis.

Understanding and calculating CLV isn’t just about crunching numbers. It’s about gaining insights into the value each customer brings to your business and using this knowledge to make informed decisions in marketing, sales, and customer service strategies.

Utilizing CLV for strategic decision making

Understanding Customer Lifetime Value is a powerful tool for strategic decision making in various aspects of your business.

Allocating marketing budgets effectively

CLV helps in identifying which customer segments are the most profitable. This insight allows businesses to allocate their marketing budgets more efficiently, focusing more resources on retaining high-value customers and acquiring similar new ones.

Product development and innovation guided by customer preferences

By analyzing the purchasing patterns and feedback of high CLV customers, companies can tailor their product development and innovation efforts to meet the needs and preferences of their most valuable customers, thereby ensuring continued relevance and appeal in their offerings.

Customer segmentation and targeted communication strategies

CLV is instrumental in segmenting customers based on their value. This segmentation enables businesses to create targeted communication strategies, offering personalized experiences and promotions to different customer groups, enhancing engagement and loyalty.

Long-term business planning and growth strategies

A clear understanding of CLV aids in forecasting future revenue and making informed decisions about business growth strategies. It allows businesses to plan for long-term sustainability by focusing on nurturing relationships with their most valuable customers.

Challenges in measuring and maximizing CLV

While CLV is a valuable metric, measuring and maximizing it comes with its set of challenges.

Data collection and analysis challenges

Accurately calculating CLV requires comprehensive and high-quality data. Gathering this data, ensuring its accuracy, and analyzing it can be complex, especially for businesses without advanced data management systems.

Balancing short-term gains with long-term customer relationships

Businesses often struggle to strike a balance between pursuing short-term profits and investing in long-term customer relationships. Focusing too much on immediate sales can lead to strategies that might alienate high-value customers, while investing heavily in long-term relationships may impact short-term financial performance.

Adapting to market changes and customer behavior trends

The dynamic nature of markets and customer preferences can make CLV a moving target. Businesses need to continuously adapt their strategies to reflect changes in customer behavior and market trends to maintain and enhance the CLV.

Despite these challenges, the benefits of understanding and utilizing CLV are substantial. It empowers businesses to make more informed decisions, ensuring a more customer-centric approach that drives long-term profitability and sustainability

Wrapping up

Customer Lifetime Value (CLV) is a vital metric that offers an in-depth understanding of a customer’s value over time, guiding key business decisions in marketing, product development, and customer engagement. Its importance lies not only in its calculation but also in its continuous application and optimization in response to changing market dynamics and customer behaviors. Integrating CLV insights into your overall business strategy can lead to more informed, strategic decisions, fostering sustainable growth and long-term profitability.

Ready to maximize your customer relationships? Contact us to explore how our services can boost your understanding and application of Customer Lifetime Value. Let’s place your customers at the core of your strategy for unparalleled business success. Reach out today!

Share on: