Every so often, the same question makes the rounds in the eCommerce universe: “Is Magento dying?”

We’ve asked it ourselves. Some of our clients have too, especially when evaluating replatforming. The name ‘Magento’ doesn’t show up in top eCommerce trend reports as often as it once did, and SaaS platforms like Shopify are gaining ground fast. Feels like everyone’s moving on.

But the reality in 2025 is more nuanced.

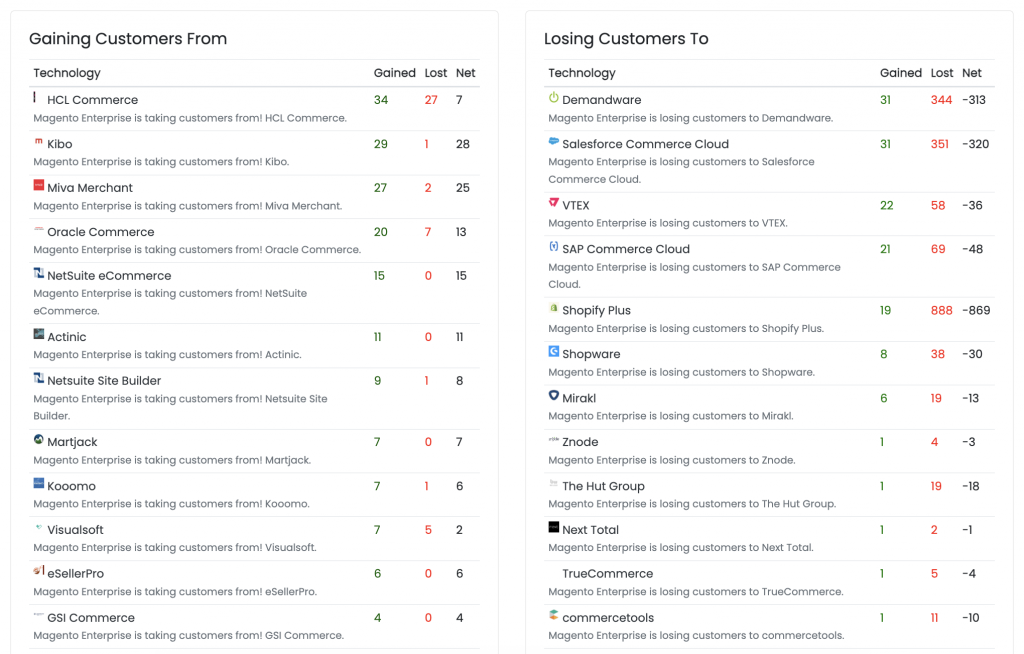

Yes, Magento’s active store count is shrinking. Yes, merchants are leaving, some for lower costs, others for faster iteration or fewer technical dependencies. But Magento also continues to serve those with complex product logic and integrations. And even now, it’s gaining users from legacy platforms and holding its own.

Let’s unpack where this concerning narrative comes from, what the numbers show about platform switching, which businesses still choose Magento, where the platform stands now, and what’s likely to come next.

For those looking to learn more general information about what Magento is, its features, pros and cons, and pricing, we’ve put together the complete guide to the Magento (Adobe Commerce) eCommerce platform.

Where the “Magento is dying” narrative comes from

The idea that Magento is on its way out isn’t coming out of nowhere. It’s a mix of ecosystem shifts and some stats that, when taken together, can paint a misleading picture.

1. Magento → Adobe rebranding

Adobe acquired Magento in 2018. What used to be one platform and a familiar name, Magento, now refers to two separate products: Magento Open Source (free) and Adobe Commerce (enterprise edition). Adobe’s branding leans heavily toward the paid version, and many product updates and official documentation focus there, which creates uncertainty for merchants still using or considering the free version.

Also read:

Adobe Commerce vs Magento Open Source: Detailed Features Comparison

2. High-profile replatformings

When well-known brands move from Magento to Shopify, Salesforce, commercetools, or another platform, those stories get shared widely. Meanwhile, success cases going the other way rarely make headlines, making it seem that everyone is leaving Magento, even if many businesses still use it.

3. Net losses to SaaS

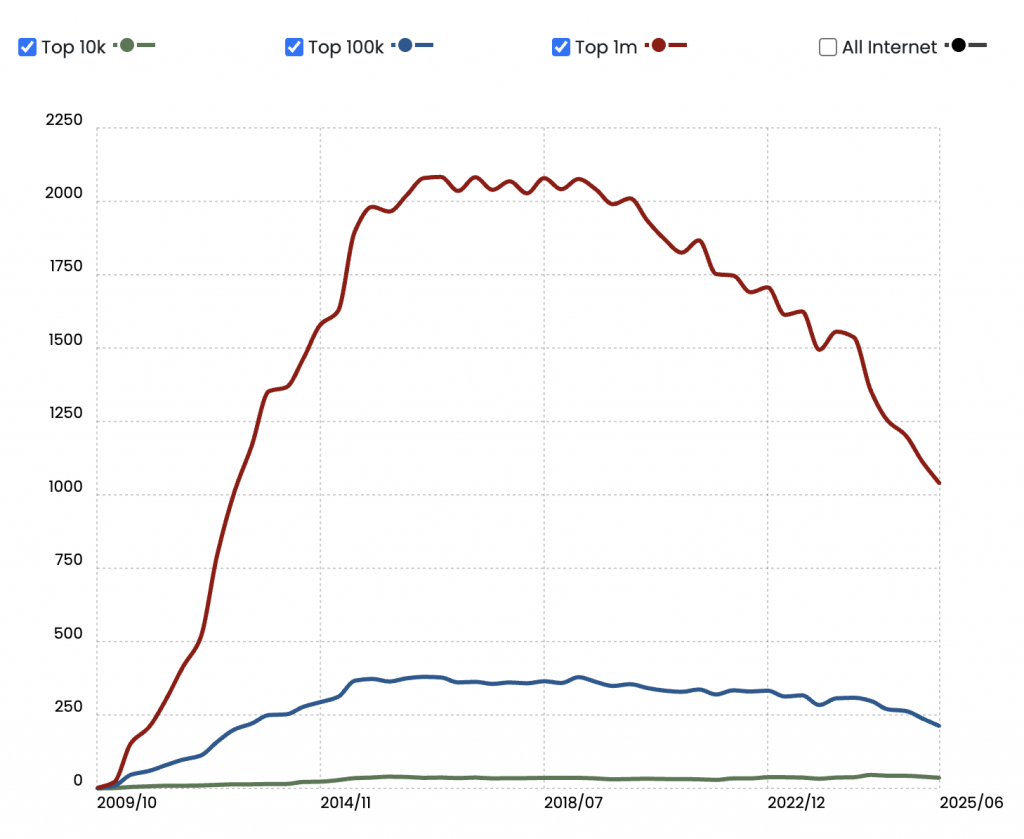

Recent data backs up the perception, as Magento’s store count is trending down. BuiltWith shows Magento powering just over 100,000 live sites in August 2025, down from previous years. Shopify alone gained 520 stores from Magento in the past 90 days, while Magento lost more stores than it gained.

4. Operational costs

Magento requires more technical expertise to run and maintain. Unlike Shopify or BigCommerce, Adobe Commerce still requires merchants to manage hosting, security patches, PCI compliance, and other key tech tasks. While some enjoy the flexibility, for others, it’s too demanding and a reason to leave.

5. Magento 1 (and Magento 2) EOL?

Magento 1 reached end-of-life in 2020, and many merchants remember the disruption it caused. Magento 2 is on a different trajectory, with Adobe continuing to release new versions, invest in the platform, and provide a rolling support lifecycle that extends with each release.

The latest version, 2.4.8, is supported through April 2028. But that’s not the end of Magento 2. Future versions are expected to follow, with new support timelines extending further. For teams planning long-term, Adobe Commerce, Magento Open Source, and the global developer community are all contributing to its stability and longevity.

Magento vs. Shopify

Shopify has become the most common destination for merchants leaving Magento. In the last 90 days alone, 1,765 stores left Magento, and 520 of them moved to Shopify. (source: BuiltWith)

As of Q2 2025, there are over 2.66 million live Shopify stores, and that number continues to grow (+3.0% QoQ, +9% YoY), according to Store Leads. Magento, in contrast, has 126,000 live stores, down 2.3% QoQ and 11% YoY. It still has a strong open-source legacy and foothold in complex setups, but its active store count is decreasing.

If we look across industries, Shopify dominates D2C categories:

- Apparel (28.6%)

- Home & Garden (12.1%)

- Beauty & Fitness (11.0%)

Magento remains more common in sectors with complex catalogs or B2B needs:

- Home & Garden (14.9%)

- Apparel (10.7%)

- Business & Industrial (8.9%)

This tracks with what each platform prioritizes: Shopify simplifies go-to-market, while Magento gives dev teams more control over catalog structure, pricing logic, and integration flexibility.

Why merchants switch from Magento to Shopify

- Total cost of ownership and speed to market – Shopify’s predictable monthly pricing and fully managed infrastructure make it especially appealing for brands without large technical teams

- Shopify Plus starts at $2,300/month

- Adobe Commerce licensing can run from $40K–$200K+ per year, depending on hosting, etc.

- Built-in checkout – fully hosted and optimized by default, and while Magento merchants using custom or optimized checkout flows can match or even exceed Shopify’s performance, it requires hands-on development and optimization

- App integrations – Shopify has over 16,000 apps, compared to roughly 5,700 for Magento, with shorter time-to-value and integrations that are easier to implement

- Lower operational overhead – unlike Magento, Shopify handles hosting, security patching, and PCI compliance at the platform level, often cited as a key reason for switching

- B2B support catching up – recently improved features like company profiles, custom catalogs, payment terms, and order management have made Shopify a more viable replacement for Adobe Commerce in mid-market B2B use cases.

When Shopify fits best

Shopify is often the right choice for brands that prioritize speed and a fully managed service model with limited in-house development resources. Its streamlined backend and built-in checkout make it easy to iterate quickly for DTC-first businesses focused on maximizing conversion. It also works well for merchants looking to consolidate retail and wholesale operations within a single admin environment, especially with its expanding native B2B features.

When Magento is still the better choice

Magento continues to stand out in setups that demand complex product data, advanced pricing rules, or custom business logic, like multi-store setups with regional differences in catalog and currency. It is also chosen by brands that need full control over infrastructure and ERP, PIM, or other system integrations, and remains the go-to platform for projects that depend on custom middleware.

Magento vs. other eCommerce platforms

Shopify may be the most visible alternative to Magento, but it’s not the only one. According to BuiltWith, platforms like commercetools, WooCommerce, Salesforce Commerce Cloud, BigCommerce, and VTEX continue to pull away Adobe Commerce clients. Magento has become one of several options in the market, increasingly defined by composable architecture, open SaaS, and integrated CRM/marketing stacks.

Here’s how Magento compares to the key enterprise players in 2025.

Magento vs. Salesforce Commerce Cloud

Based on BuiltWith data, Adobe Commerce lost 320 customers to Salesforce Commerce Cloud as of August 2025, more when factoring in its Demandware alias.

Salesforce Commerce Cloud continues to be a go-to platform for global brands already invested in the broader Salesforce ecosystem, which is known for CRM integration, personalization through Salesforce Marketing Cloud, and unified customer data across platforms. It continues to attract Magento merchants looking to trade backend flexibility for marketing automation, but at a high cost and with less backend control compared to Magento.

Magento vs. WooCommerce

Adobe Commerce has lost over 3x as many customers as it gained from WooCommerce Checkout, according to BuiltWith.

WooCommerce appeals to small and mid-sized merchants, especially those already using WordPress, as it offers a familiar CMS environment and lower maintenance. It’s highly extendable via plugins and can be customized by non-technical teams with minimal effort. For businesses that don’t require advanced catalog rules or heavy backend integrations, WooCommerce often feels less resource-intensive than Magento.

Magento vs. BigCommerce

BigCommerce positions itself as an open SaaS alternative – less restrictive than Shopify, but more manageable than Magento. It appeals to merchants who want API access and multi-store support, without the infrastructure demands of open-source platforms.

Magento still offers more backend control, deeper customization, and a mature ecosystem for B2B features and multi-store complexity. However, BigCommerce has gained adoption among merchants migrating off Magento to reduce operational overhead and licensing costs, especially in the mid-market.

While precise net switching data isn’t available at the enterprise level, BigCommerce frequently appears in Magento replacement RFPs for businesses that want flexibility without full stack ownership. In these cases, Magento loses customers not because of missing features but because teams no longer want to maintain those features themselves.

Magento vs. commercetools

According to BuiltWith data (cumulative through August 2025), Adobe Commerce has lost 11 customers to commercetools while gaining just one, resulting in a net loss of 10.

Known for its headless-first, API-native model, commercetools is often chosen by large teams designing multi-brand ecosystems where catalog, checkout, CMS, and PIM are independently managed. While Magento allows custom-built frontends and backend logic, it’s not composable by default. For enterprise teams building exactly what they need using a suite of independently deployable services, commercetools can be the cleaner starting point.

Also read:

commercetools vs Adobe Commerce: Which eCommerce Platform is Best for You?

Other enterprise platforms gaining Magento clients

SAP Commerce Cloud, often selected by companies already running SAP ERP systems, offers tight integration with backend finance, logistics, and procurement workflows. According to BuiltWith, Adobe Commerce has a net loss of 48 customers to SAP Commerce Cloud, typically those for whom ERP alignment and overall system consolidation outweighs frontend flexibility.

Similarly, BuiltWith data shows Adobe Commerce with a net loss of 36 customers to VTEX, which positions itself as a composable, API-first platform with strong marketplace functionality and presence in Latin America and parts of Europe. For brands pursuing unified commerce, VTEX’s bundled marketplace and headless tools can be compelling.

Magento’s position in this entire group is defined by its extensibility and ability to handle deeply customized workflows. It’s best suited for teams that want to build tailored experiences across frontend and backend, and are prepared to manage infrastructure, security, and upgrades. Adobe Commerce also benefits from integration with Adobe Experience Cloud products, which can be a differentiator for content-heavy or design-led brands.

Magento platform status in 2025

As of August 2025, BuiltWith tracks roughly 105,000–106,000 live Magento sites, with over 639,000 total known historically. Magento 2 makes up the majority of live usage, with about 72,700 stores, and Magento 2.4 accounts for ~40,000 of those. The older Magento 1 footprint, while still recorded, is no longer active in any supported capacity.

Magento’s share in the ‘Top 1 Million websites’ currently sits at 1.05%, making it the 4th most popular open-source eCommerce platform in that tier, still ahead of many niche stacks but down from previous years. In the U.S. alone, 23,538 sites run on Magento 2.

Active releases and long-term support

Magento is still under active development:

- Magento Open Source 2.4.8 was released in April 2025, with support for PHP 8.4 and MariaDB 11.4

- Security-only patches for 2.4.7 and 2.4.8 continue to ship on Adobe’s monthly Patch Tuesday cycle

Adobe Commerce follows the same core versioning and receives additional enterprise modules and service integrations. Both benefit from shared security infrastructure, but support models and SLAs differ depending on license type.

Growing Magento ecosystem and community

BuiltWith trend data shows that Adobe Commerce losing net customers is a gradual but consistent movement, reflecting a broader shift toward composable and SaaS models, especially at the enterprise tier.

That said, Magento is evolving in a more focused lane:

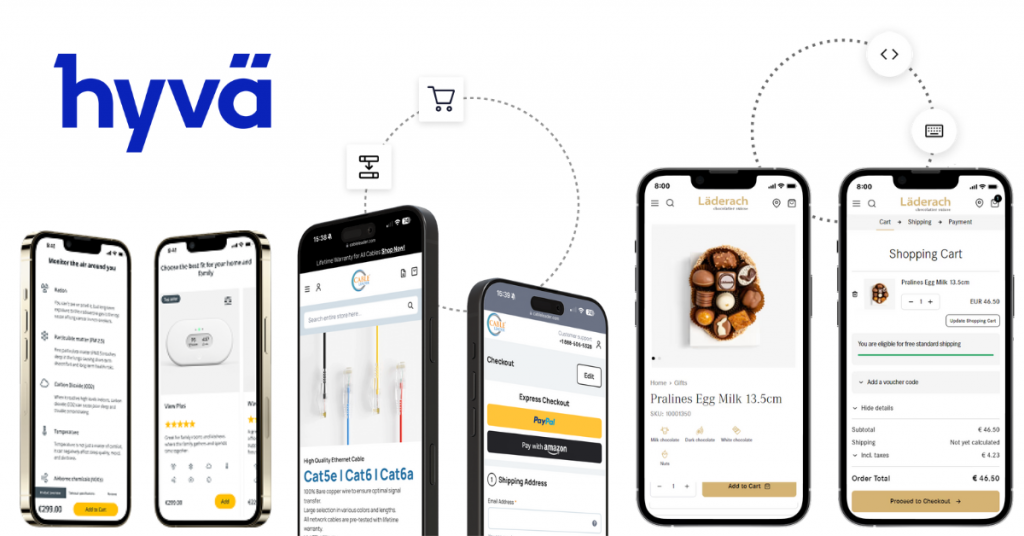

- Hyvä continues to gain traction as a preferred frontend stack for Magento 2 merchants, improving performance and developer experience

- Adobe is actively investing in Edge Delivery Services, a composable storefront architecture powered by Adobe Experience Manager and built for faster content delivery

- Magento continues to offer deep integration flexibility, allowing complex ERP, PIM, OMS, and custom middleware setups that many SaaS platforms cannot match.

The ecosystem around Magento has stayed active and, in some areas, it’s grown stronger. Regular meetups, code contributions, and independent vendor innovation have helped keep Magento’s community tightly connected, even as its global footprint shrinks. For merchants who prioritize flexibility and want to stay connected to a hands-on, developer-driven community, Magento continues to offer a home.

How is Magento changing (and why that’s good)

Magento in 2025 is deliberately improving around real merchant and developer needs: frontend performance, AI-driven tools, community control over the open-source future, and continued backend flexibility for complex builds.

Frontend modernization

One of Magento’s most visible shifts is how merchants are rebuilding their storefronts. Traditional Luma-based themes are being phased out in favor of faster alternatives. The most popular of these is Hyvä, now widely adopted by Magento 2 stores across the mid-market and enterprise segments. Hyvä significantly improves performance scores and reduces complexity for frontend teams without requiring a full composable setup.

At the enterprise level, Adobe’s Edge Delivery Services introduces a new headless storefront option, built on Adobe Experience Manager and designed for teams invested in Adobe’s content workflows. Though still early in adoption, it signals Adobe’s continued investment in Magento’s frontend modernization.

AI-powered features

AI is already embedded in Adobe Commerce. Live Search and Product Recommendations, powered by Adobe Sensei, use real-time shopper behavior to personalize search results and product carousels. These services run on Adobe’s cloud and are available to merchants using the Commerce edition.

While Magento Open Source doesn’t include native AI tools, some merchants integrate third-party AI services or custom models into search, product upsell, customer service, and other features. The platform’s open nature allows for deep AI experimentation, though setup and scaling require technical involvement.

Who Magento still serves best

Magento solves specific, high-value problems for businesses with complexity at their core. While many merchants have shifted to SaaS platforms to simplify operations, Magento continues to serve those with use cases that demand flexibility and architectural control.

It remains a strong choice for businesses with large or multi-layered catalogs, custom product logic, or non-standard pricing models that require more than plug-and-play functionality. Brands with multi-store, multi-region setups where catalog structure, language, tax, and currency rules vary by market often stick with Magento because of its native capabilities in these areas.

Magento also holds its ground in B2B commerce, where workflows like company accounts, quoting, tiered pricing, and custom catalogs are needed. While platforms like Shopify and BigCommerce have introduced B2B features, Magento’s model still offers deeper configuration options and more control when building custom user experiences.

For teams with strong development support or agency partners who can manage deployments, integrations, and patches (scandiweb 😉), Magento offers an advanced stack that doesn’t restrict how the business grows over time. It’s not the fastest or cheapest to launch, but it remains one of the most adaptable, and we believe that still counts for something.

Why some merchants are leaving

Most merchants leaving Magento are likely leaving because it no longer fits the way they want to operate.

For many, the tipping point comes down to internal capacity. Maintaining Magento means handling patches, upgrades, QA, extension compatibility, and performance tuning, which is feasible with a dedicated team or a retained agency. But with tight budgets, merchants often reassess whether they want to own that layer of complexity at all. Besides, skilled and certified Magento developers are hard to find.

For others, long release cycles and heavy customization requirements cause friction. While Magento offers complete control, even small changes can require developer input, slowing down marketing teams and time-to-iteration compared to platforms with drag-and-drop workflows and native app ecosystems.

How to decide if Magento is for you

Magento is still a smart investment:

- If you’re dealing with non-standard product types, complex checkout flows, regional logic, or deep ERP/PIM integrations

- If you want to future-proof your architecture with a customizable backend stack.

But if your team values speed and simplicity, or if you’re trying to reduce reliance on dev resources, Magento might feel heavy. In the end, it’s about whether Magento still matches what your business needs to run and grow today and in the years ahead.

Magento is NOT dying

Magento Open Source and Adobe Commerce are both still very much alive in 2025. Releases are shipping on schedule, security patches are routine, modern frontends are gaining traction, and the platform still powers thousands of stores that have the ability to customize everything from checkout to product logic to infrastructure.

Magento might be losing some customers to SaaS, but for the businesses that need it and for the developers who continue to build on it, Magento isn’t going anywhere.

At scandiweb, we’ve loved Magento since 2009, and since then, we have gathered the largest certified Magento developer team in the world. Contact us today for a free consultation, and we’ll help evaluate if Magento still fits your needs or build you a better alternative.

Share on: